Hey VeveFox Insiders! 👋

Welcome back to your go-to source for data-driven insights into the fascinating world of Veve collectibles.

In this edition, I'm excited to introduce a trio of custom segmentation metrics that promise to unlock new, exciting insights into Veve's user base.

💎 Collector Score: a proprietary scoring system to categorize users into seven distinct tiers, ranging from Diamond Hands Collector to Aggressive Flippers.

⏳ Activity Status: a segmentation based on the time elapsed since the last activity from a user, providing insights into current user activity.

🔁 Engagement Level: a segmentation based on the frequency of transactions, offering a perspective on the loyalty and consistency of user activity.

Let's dive right in!

If you don’t want to miss out on any updates on the latest Veve insights and trends don't forget sign up for free to get every new issue directly into you inbox!

💎 The Collector Score

The Collector Score is a custom metric designed to classify users as either collectors or flippers. This segmentation is based on their trading behavior, specifically the percentage of items a user sells from their portfolio. The score ranges from "Diamond Hands Collector" for those who retain most of their purchases to "Aggressive Flipper" for users who sell the majority of their purchases.

Looking at the 2023 active user base, this metric reveals a nearly even split between collectors and flippers within the Veve community, which highlights the diverse interests and strategies of its members.

Looking at this metric in the context of a collectible, can provide us with crucial insights into the expected price stability of the collectible. For instance, in the case of Donny, which is primarily held by Diamond-Hands Collectors, we can expect relative price stability. On the other hand, if a collectible was mainly in the hand of flippers it would translate to unpredictable price action.

⏳ Activity Status

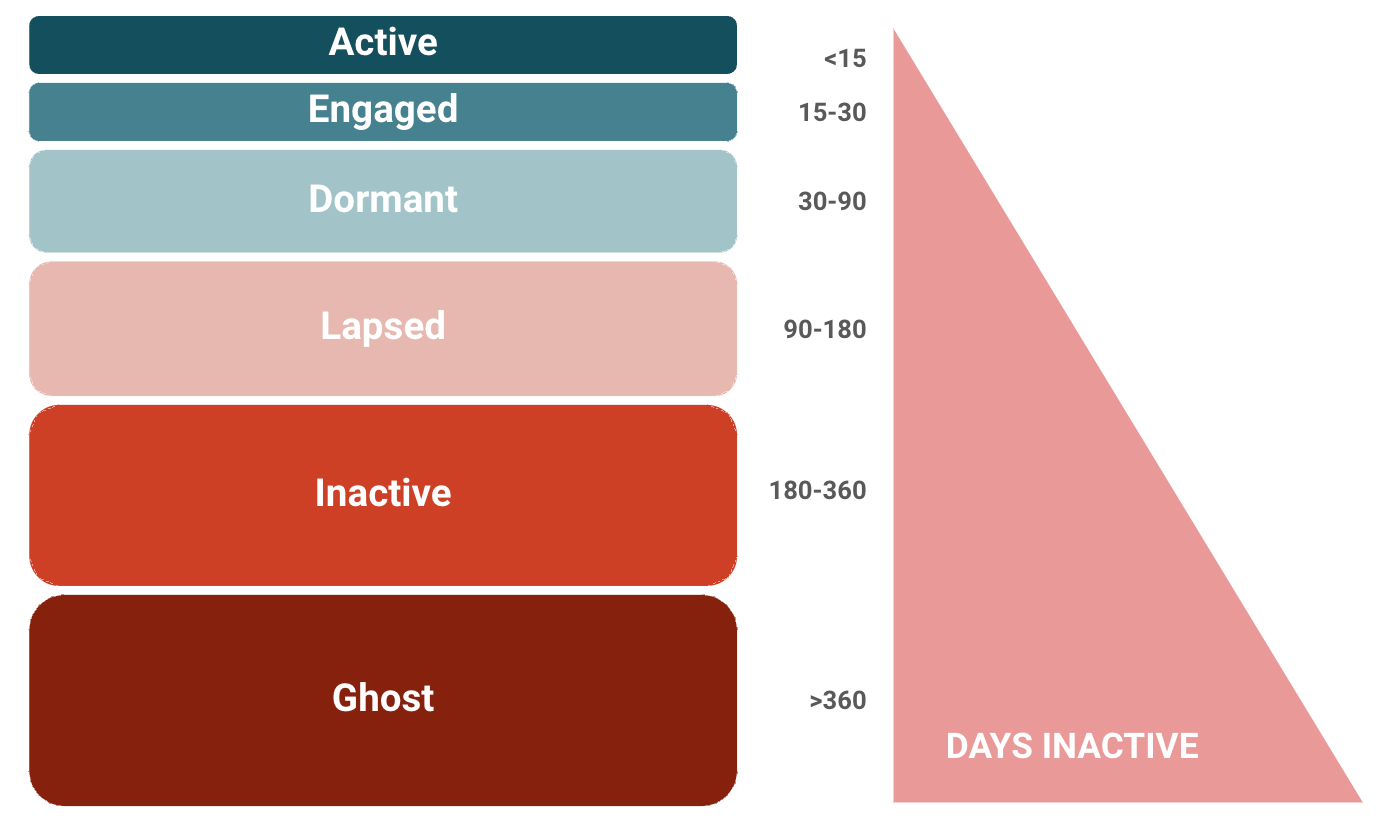

The Activity Status metric categorizes users based on their last active day, depending on how many days have passed since their last transaction. This segmentations provides insights into how many users might sit on the sidelines or might have abandoned the app.

This metrics is especially interesting in the context of analysing the holders of a specific collectible, providing an understanding of the active vs. inactive user ratio which might impact the collectible’s liquidity. In the case of Donny, most of the tokens are in wallets that have been active recently, which is a positive sign.

Note: Activity is based on making a transaction, either in the store (mint) or in the secondary market. Other forms of engaging with the app, i.e. checking the app, making a listing, commenting on the feed, are not considered, given that I have no data on those activities. This means that a Ghost user that has not made a transaction for more than 360 days, could still have been ‘active‘ on the app in other ways.

🔁 Engagement Level

The Engagement Level metric offers a long-term view of user activity, categorizing users based on their consistency of engagement over time calculated as the proportion of weeks they have been active since their first transaction on Veve. This offers insights into the consistency of user participation and the depth of their engagement.

Looking at the 2023 active user base, the metric shows that the majority of users fall under the sporadic category and only around 10% are active on a regular basis. This explains why the daily active user count is rather small compared to the yearly active user count. It highlights that users, regardless if collectors or flippers, participate selectively on the market, only going for those drops that they either like to collect or which they believe they can make a quick profit. However, having 5% of Loyal users, that are active almost every week, is also worth noting.

Gini Coefficient: Collectible Distribution Inequality

While not a user segmentation metric, the Gini Coefficient offers a unique perspective on collectible distribution equality. I adapted the Genie Coefficient, used in economics as a measure of distribution inequality, to measure the distribution equality of a collectible among its holders. A low score (close to 0) suggests equal distribution of a token, i.e most wallets holding equal amounts, while a high score (close to 1) suggests unequal distribution, i.e a few wallets holding most of the supply. In essence this gives us an indication on how susceptible a collectible is for market manipulation. A score above 0.4 is seen as a high score, indicating potential market manipulation risks.

Donny's coefficient of 0.59 suggests uneven distribution, with a few wallets holding a significant portion of the tokens, which is evident when looking at Donny’s holding distribution.

To wrap up …

These new metrics offer a new way of looking at the Veve data and provide a more nuanced understanding of the platform's community. Through the Collector Score, Activity Status, and Engagement Level metrics, we can now gain deeper insights into the behavior and engagement of collectors and flippers.

Feel free to watch my YouTube Video for the full analysis of the 2023's active wallets and the detailed examination of Donny which demonstrate the practical application of these metrics in understanding the digital collectibles market.

Stay tuned for more updates and insights into the world of Veve!

As always, happy collecting! 💎

— Kelly aka. VeveFox 🦊

👉 If you liked this post, don’t forget to leave a like 💙

👉 If you haven’t already, be sure to follow me over on X and YouTube

👉 If you enjoy this newsletter, feel free to share it!

Note: I am not associated with Veve. I'm just a fox who is passionate about Data and Veve, and I'm excited to share my insights with all of you.

Disclaimer: Nothing in this or any other VeveFox Insider publication should be considered as financial or investment advice. Always exercise caution within the NFT space.

Hey Kelly - fantastic article once again!

I had a couple of things to throw at you, which might provide even greater insight on user engagement, but unsure if you can track this info?

1. Assets Held (LTD, Long Term Holds) vs Listed %

Generally speaking, it appears most asset categories have under 5% of listings available in market, some (like MC1 etc.) having less than 2%. This would certainly indicate collecting vs flipping, so would that impact your graph showing a somewhat 50/50 split of the 2 audiences?

2. Average Sell Price

Key Edition Numbers do take longer to sell as fewer buyers with the resources to go after them, but they often generate valuations many X above market floors. This would indicate collectors / serious collectors & traders vs. flippers as the value of the edition number is paramount. Flippers tend to sell at market bottoms, often not realising or caring about the value of the #'s they look to flip for low % gains or a few gems to gamble on the next drop for a SR. Overall though, this has the appearance of a market with lower valuations, that inflates the 'daily user' counts of flippers vs. the revenue generated through more serious edition numbers who may be in market less often, but make serious investments when an asset appears or deal is put together.

Happy to chat further, but thought I would put these ideas out there to consider - if this has already been written about, my apologies & please let me know where to find that content!

Thanks so much & keep up this fantastic research...it's really appreciated!