Hey VeveFam! 👋

As we bid farewell to 2023, it's time to reflect on a challenging yet transformative year for Veve. In this yearly review, we'll dive into the data, to uncover the highs, lows, and promising shifts that marked the Veve landscape throughout the year 2023.

If you don’t want to miss out on any updates on the latest Veve insights and trends don't forget sign up for free to get every new issue directly into you inbox!

📉 Active Wallets Trend: The decline in Engagement

No surprise here - 2023 posed significant challenges, evident in the whopping 84% decline in average monthly active wallets compared to the previous year. From the peak of 32,309 in February to the trough of 16,271 in November, it's been on an alarming decline.

Note: Activity is based on making a transaction, either in the store (mint) or in the secondary market. This means that users engaging with the app in other ways, i.e. checking the app, making a listing, commenting on the feed, are not considered here.

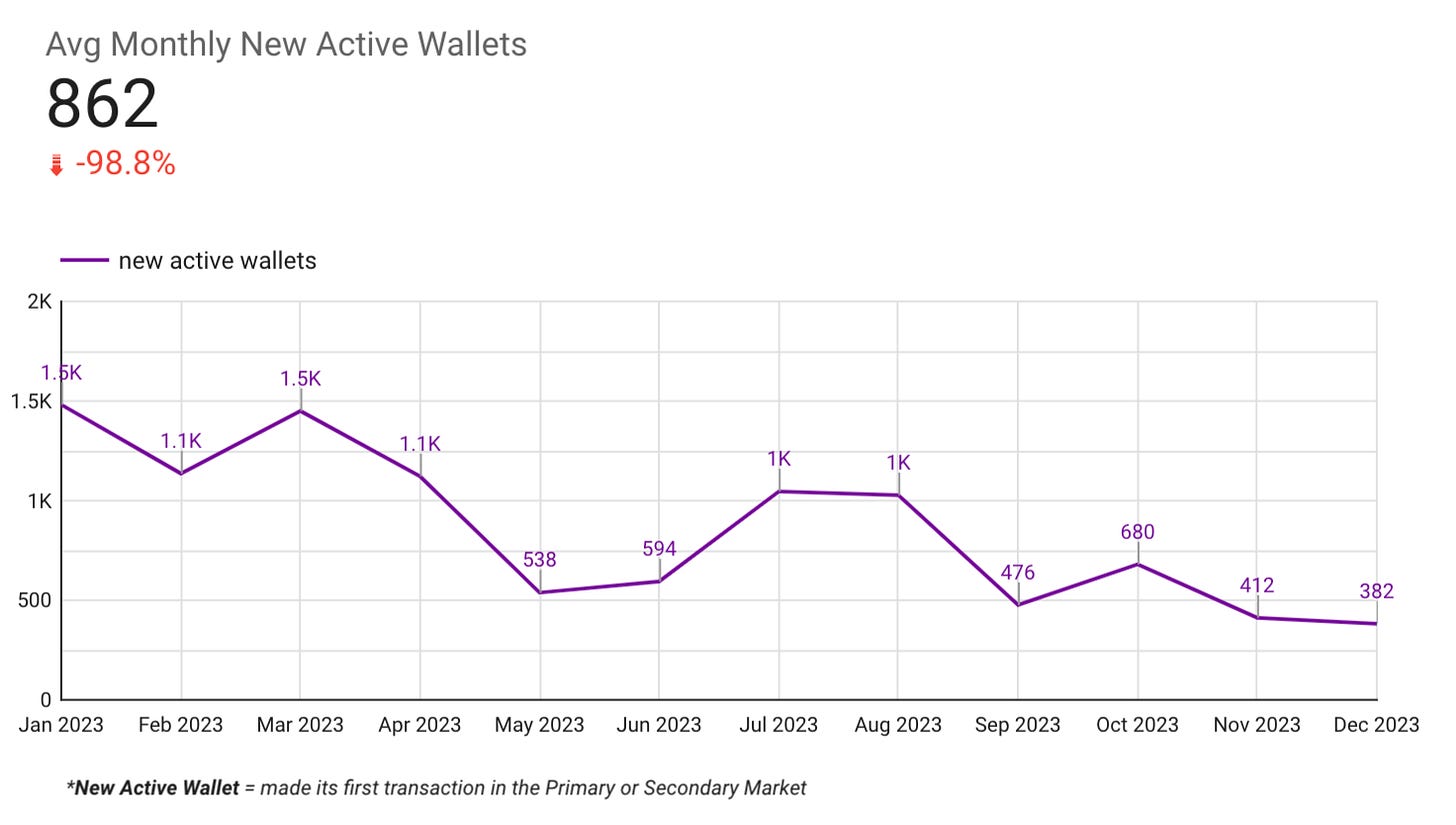

🆕 New Active Wallets: Struggles to attract new users

New active wallets had it even worse, experienced a staggering 98.8% dip compared to the previous year, averaging less than 1k new users per month. Though January started on a high note with 1,481 newcomers, by December, the numbers dwindled to a mere 382. A clear call for marketing and strategies to attract new users.

Note: “New Wallet” or “New Active Wallets” refer to wallets that have made their first transaction on Veve, either in the store (mint) or in the secondary market. This means the number of actual new installs or account creations on Veve might be higher.

🔄 Month-over-Month (MoM) Churn: A more resilient user base

On a positive note, the average MoM Churn, i.e. users that have been active in one month not returning the following month, saw a 34% decline compared to 2022, signifying a more resilient user base compared to previous year. For instance, a 33% MoM churn rate translates to a 67% MoM return rate, i.e. users active in one month return to be active the following month, emphasising user loyalty. Although the churn rate remained relatively stable at the beginning of the year it saw an increase in the second half of the year, with peaks in September and November that hint challenges, perhaps linked to less appealing drops and a struggle to retain the Comic Con influx.

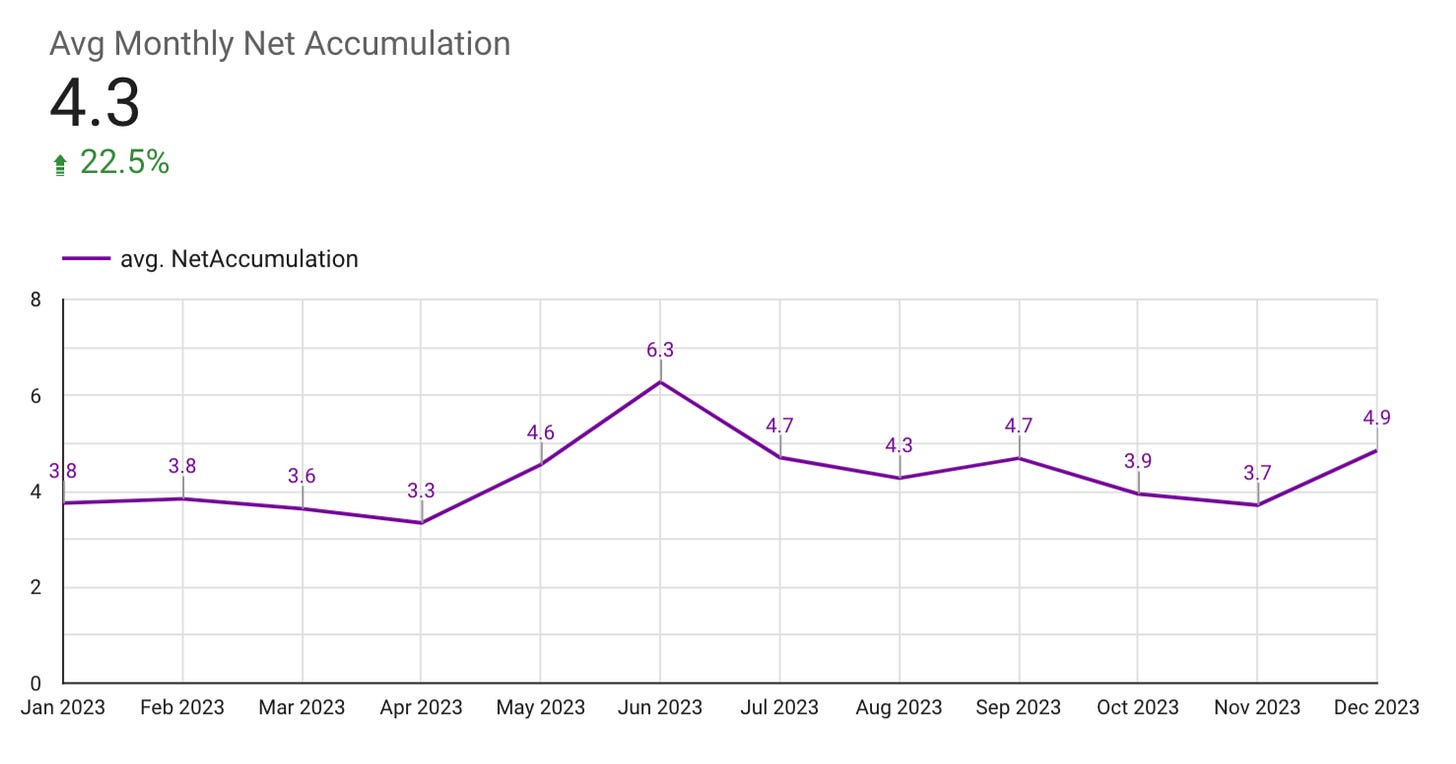

💰 Net Accumulation: Collectors on the rise

Average monthly net accumulation also witnessed a significant uptick, averaging around 4.3 throughout the year, a 22% increase compared to previous year. This signifies that, on average, users are actively growing their collections.

This is further highlighted by shift in wallet distribution by net accumulation, showing a positive trend in those with net positive accumulation over net zero and net negative accumulation. In December, 71% of users had a net positive accumulation, painting a picture of thriving collectors.

🐳 High net accumulators: Weathering the Storm

High net accumulators, representing wallets with a monthly net accumulation >100, while still a tiny percentage of active wallets at 0.63%, saw a remarkable 55% increase compared to previous year. This underscores a rise in users truly committed to collecting on Veve. Despite a dip in the latter half of the year, December hinted at a promising rebound.

🔄 Regular Wallets: An engaged core user base

Monthly Regular wallets, i.e. wallets that were active 7 days or more in a row within a month, also experience a 20% increase compared to the previous year, averaging 4.93%. This also hints at a more engaged core user base.

⚖️ Buyer-Seller Ratio: Towards a buyer-dominated market

While the average monthly buyer-seller ratio at 0.94 was similar to the previous year. The ratio flipped to >1 in August , maintaining an upward trajectory throughout the year. This signals a positive shift towards a buyer-dominated market, shaping the dynamics of the Veve ecosystem.

💭 Final Thoughts

Reflecting on the data, the highs and lows of 2023 paint a complex canvas for Veve. The decline in active wallets and the struggle to attract new users are undeniable challenges that underscore the need for innovative strategies to attract and retain users. However, it’s not all doom and gloom.

The positive shift in the MoM churn, the increase in positive net accumulation as well as high net accumulators showcase the evolving nature of our community, suggesting that collectors are on the rise. The stability in regular wallets and the shift towards a buyer-dominated market further hint at a deepening commitment among core users.

As we close the chapter on 2023, Veve stands at the crossroads of challenges and opportunities. Strengthening user engagement, expanding marketing efforts to attract new users, and enhancing the overall user experience will be crucial.

I am exited to see what 2024 has in store for us, as Veve and the Veve community continues to evolve ✨🚀

Stay tuned for more updates and insights into the world of Veve!

As always, happy collecting! 💎

— Kelly aka. VeveFox 🦊

👉 If you liked this post, don’t forget to leave a like 💙

👉 If you haven’t already, be sure to follow me over on X and YouTube

👉 If you enjoy this newsletter, feel free to share it!

Note: I am not associated with Veve. I'm just a fox who is passionate about Data and Veve, and I'm excited to share my insights with all of you.

Disclaimer: Nothing in this or any other VeveFox Insider publication should be considered as financial or investment advice. Always exercise caution within the NFT space.

Awesome read! Thank you for the amazing work you do!